by Jian Tong Chua, Quantitative Research Associate, and Winfield Xu, Director of Data Science

The 2024 housing market has demonstrated significant growth and resilience, overcoming headwinds from high interest rates to achieve a remarkable surge in home equity. This annual report examines key trends in home equity throughout the year, analyzing both national and regional data to provide a comprehensive overview of the market.

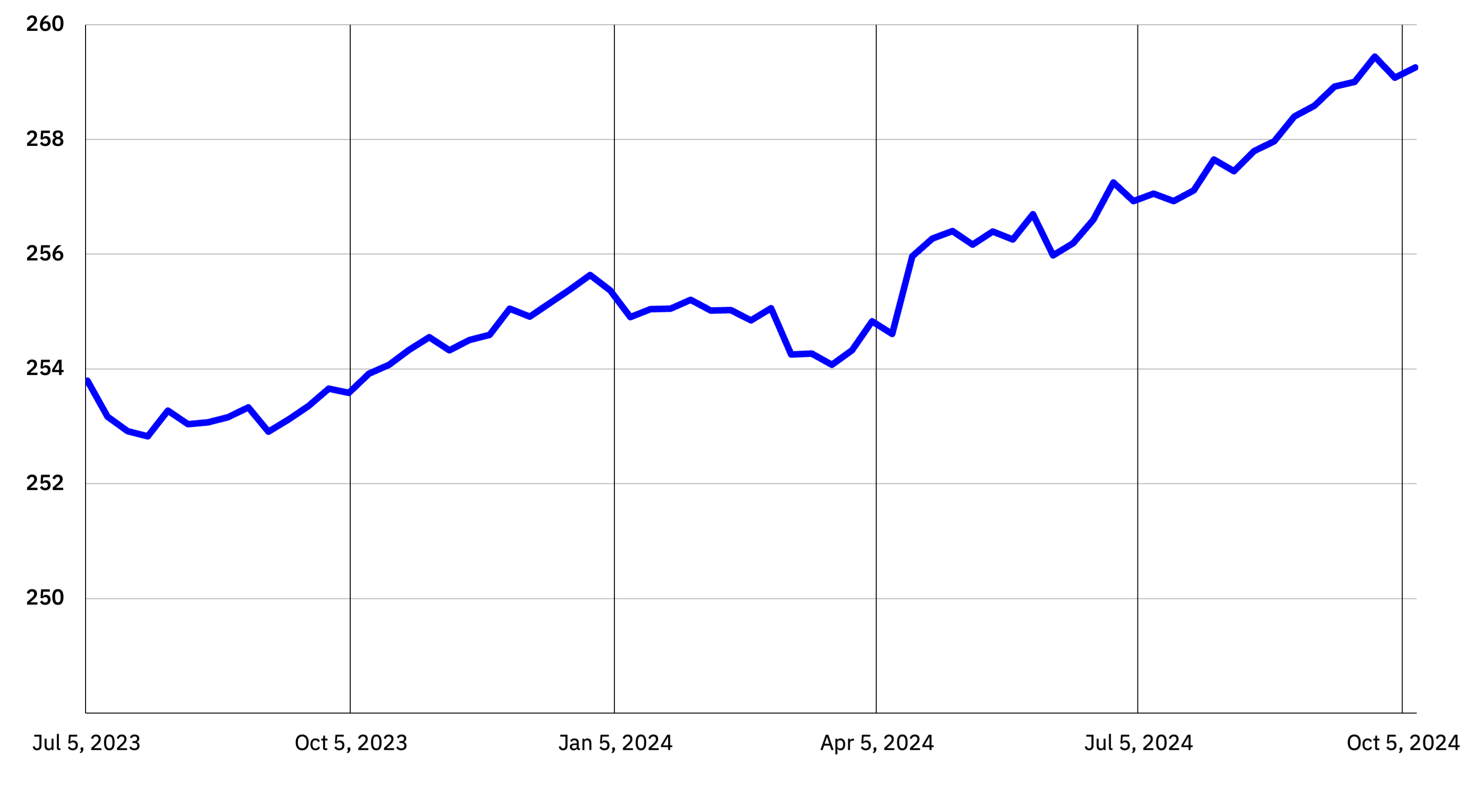

Home prices have reached record highs, with the past 12 months showing significant home price appreciation. As of July 2024, the national Case-Shiller Index reported a 4.5% year-over-year increase. Much of this growth occurred in the first half of 2024, with the index rising by 4.7% year-to-date.

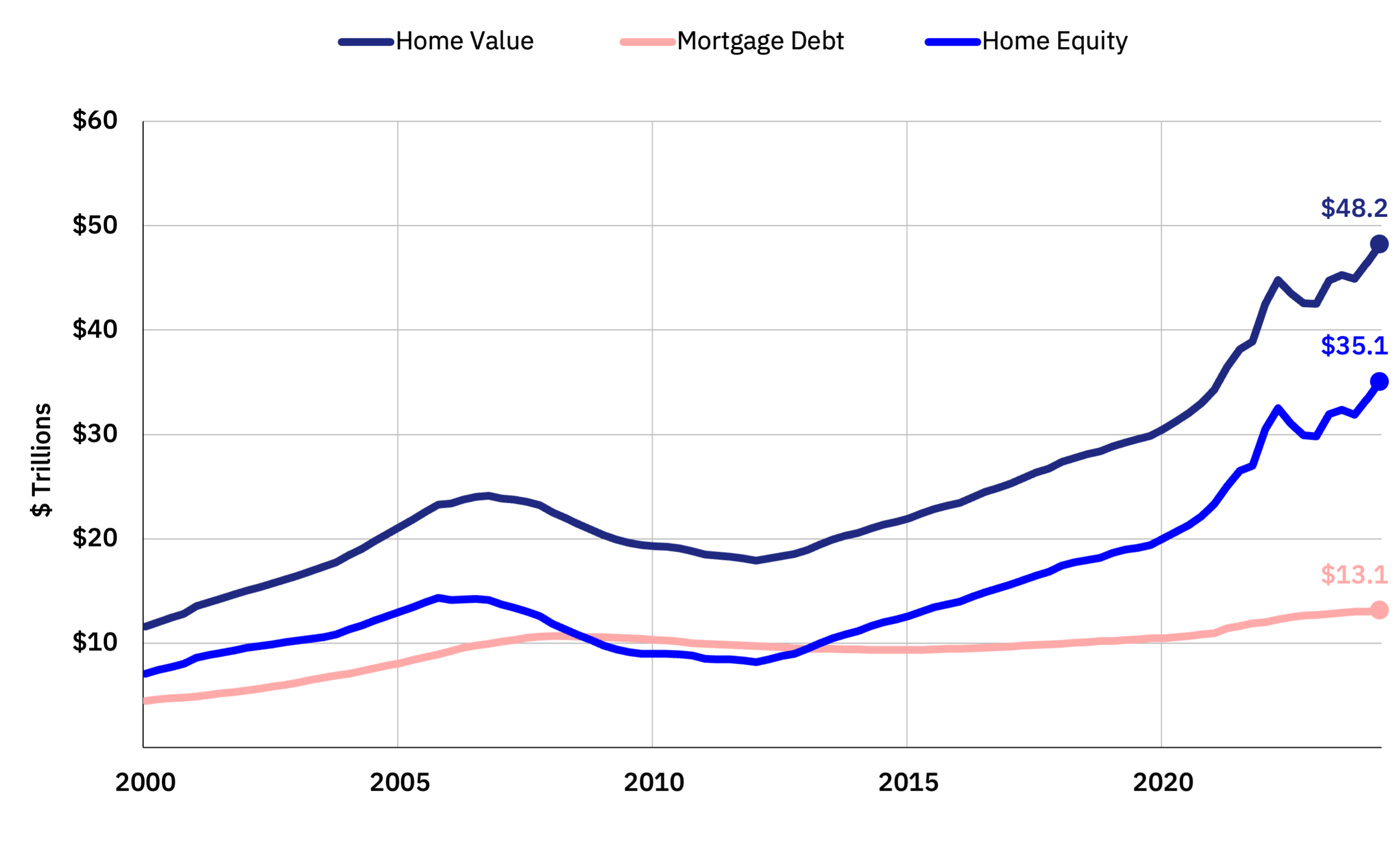

This surge in home values has substantially boosted homeowner equity. Home equity, defined as the difference between a property's market value and the outstanding mortgage balance, has reached new heights. By the end of Q2 2024, Federal Reserve data indicated total homeowner equity across the country had risen to $35 trillion, with the aggregate value of homes surpassing $48 trillion.

Performance Distribution

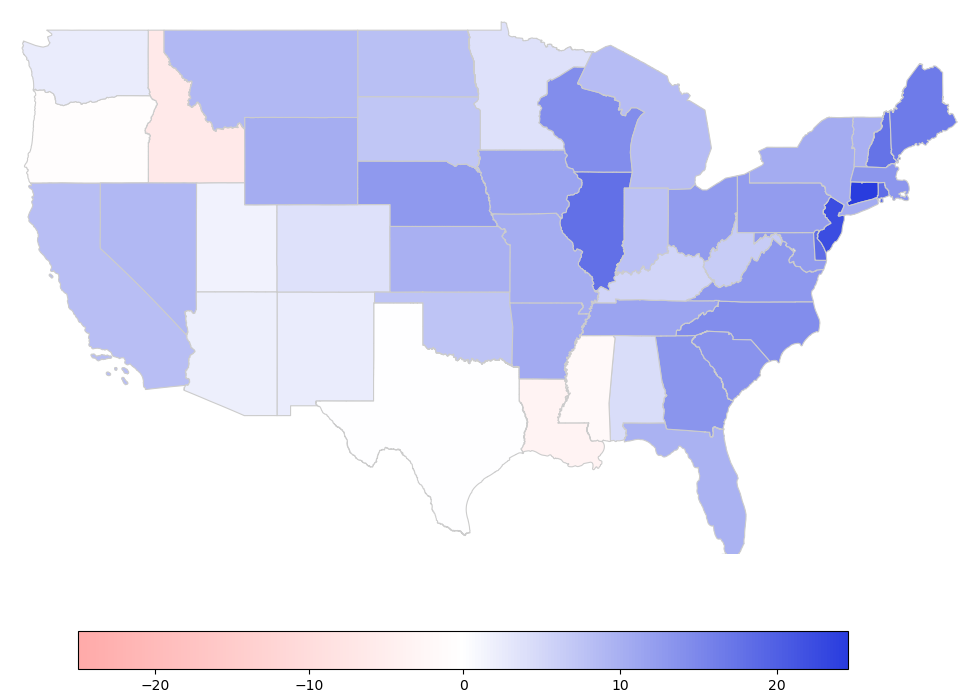

While aggregate home equity has increased at the national level, there are significant variations across states and metropolitan areas.

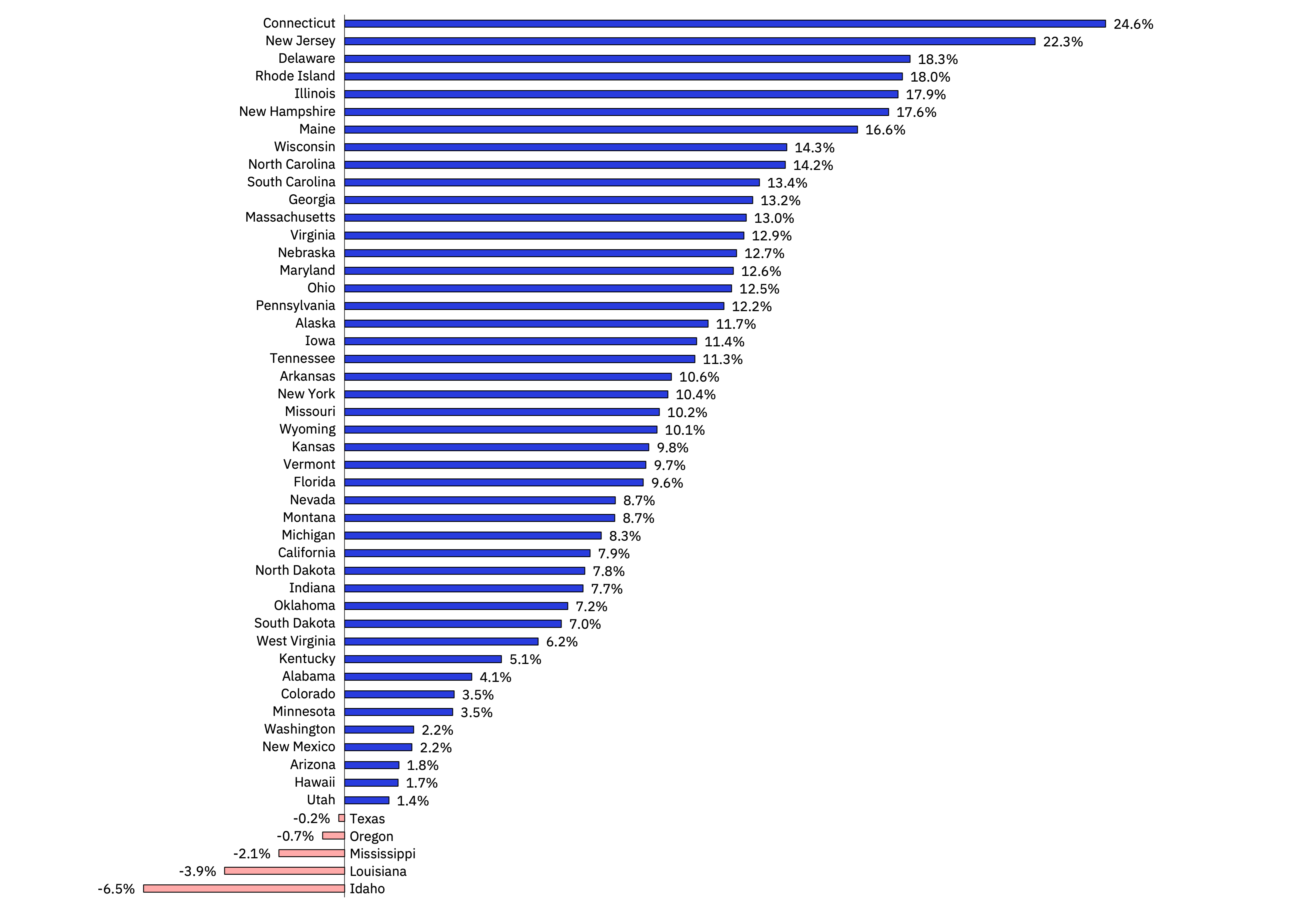

From September 2023 to September 2024, median home equity growth was positive in 45 out of 50 states. Connecticut (24.6%), New Jersey (22.3%), and Delaware (18.3%) experienced the highest growth in home equity, while Mississippi (-2.1%), Louisiana (-3.9%), and Idaho (-6.5%) saw the largest declines.

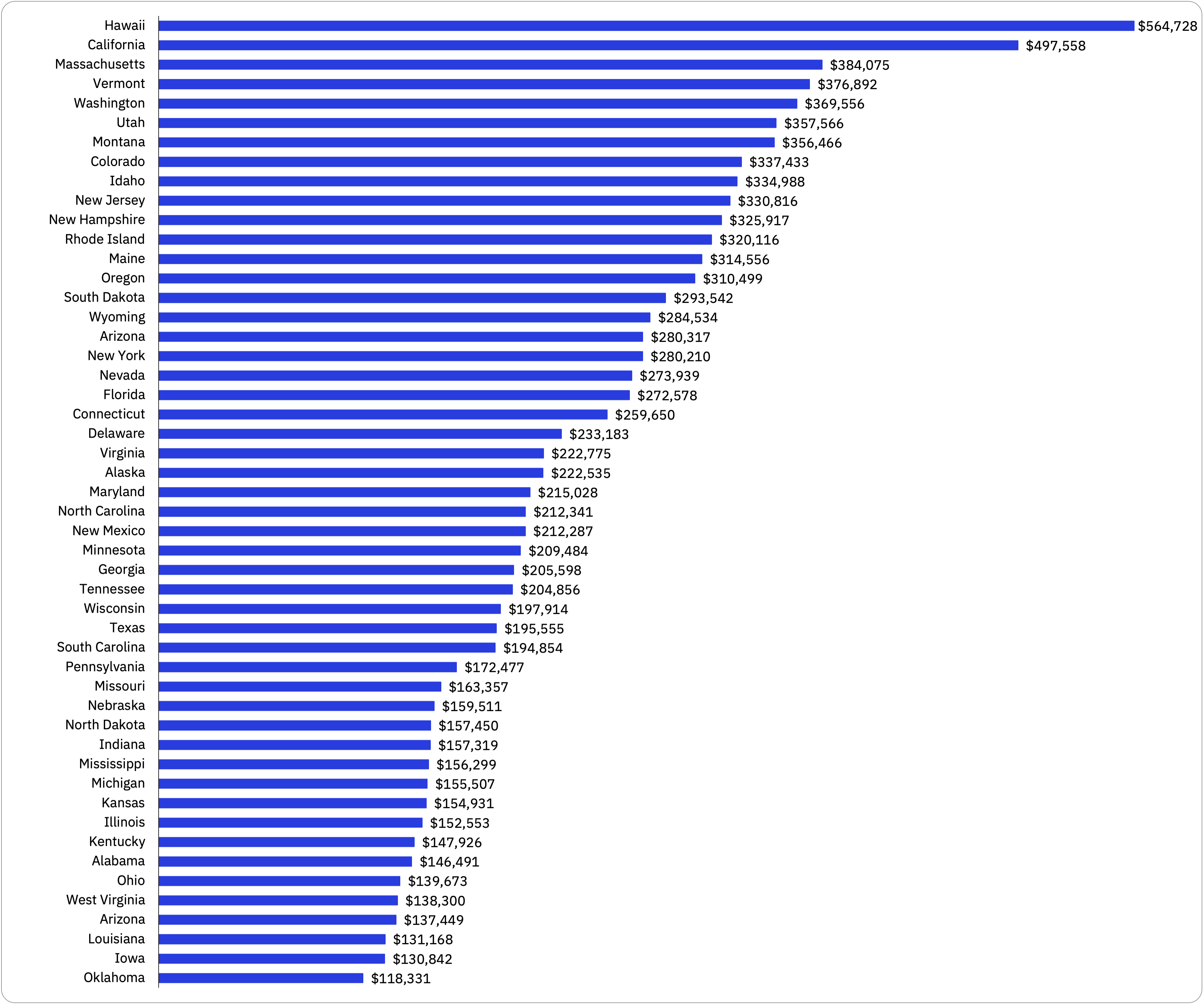

In dollar terms, Hawaii and California stand out as significant outliers in median home equity, with values of $564,728 and $497,558, respectively—nearly 30% higher than Massachusetts, which ranks third. On the other end of the spectrum, Oklahoma recorded the lowest median home equity at $118,331, amounting to just a fifth of the highest state.

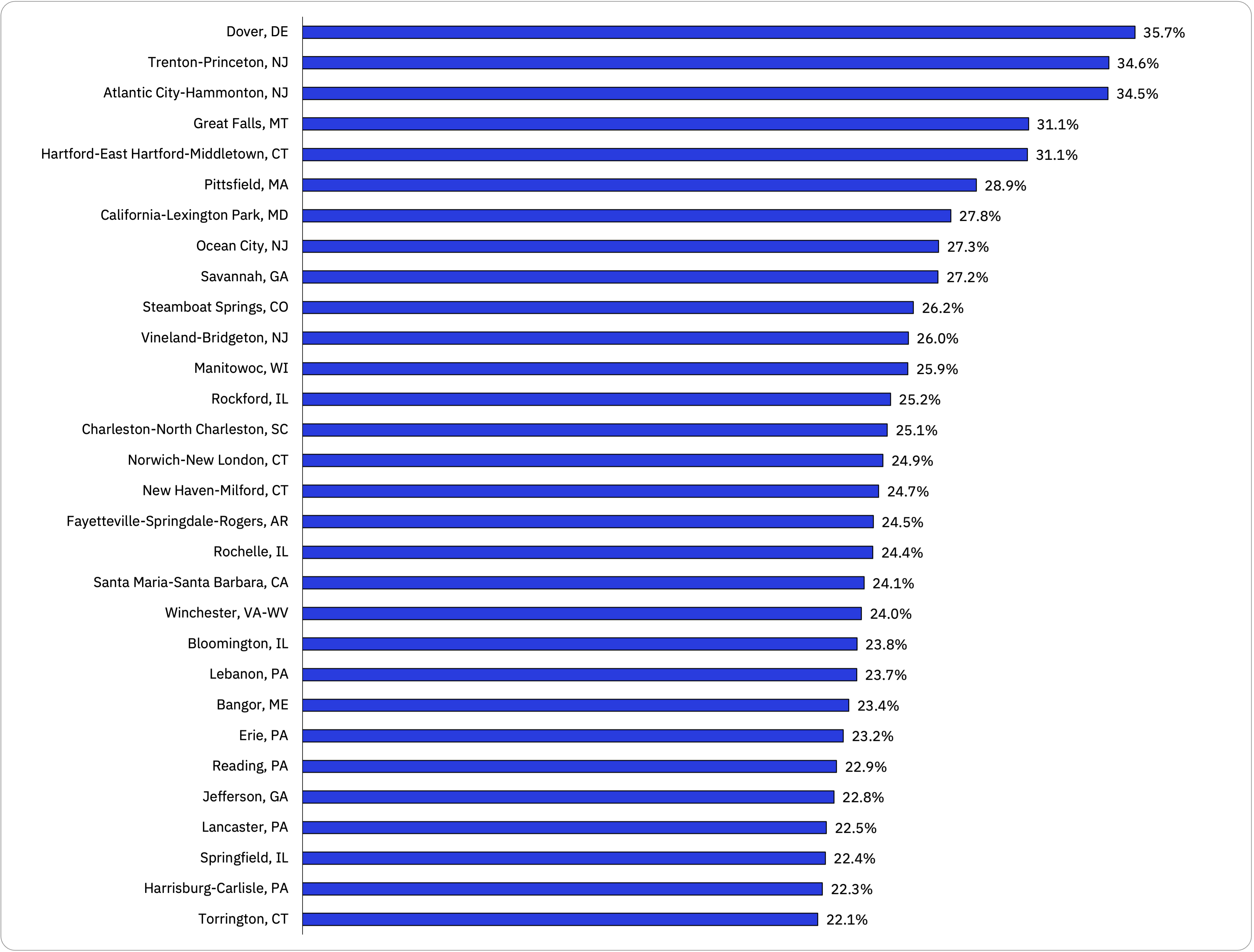

At a more granular level, Core Based Statistical Areas (CBSAs) also showed notable differences in home equity performance. Dover, Delaware emerged as the top-performing CBSA, with an impressive 35.7% year-over-year increase in home equity. Two CBSAs in New Jersey, Trenton-Princetron and Atlantic City-Hammonton also performed well, rounding out the top 3.

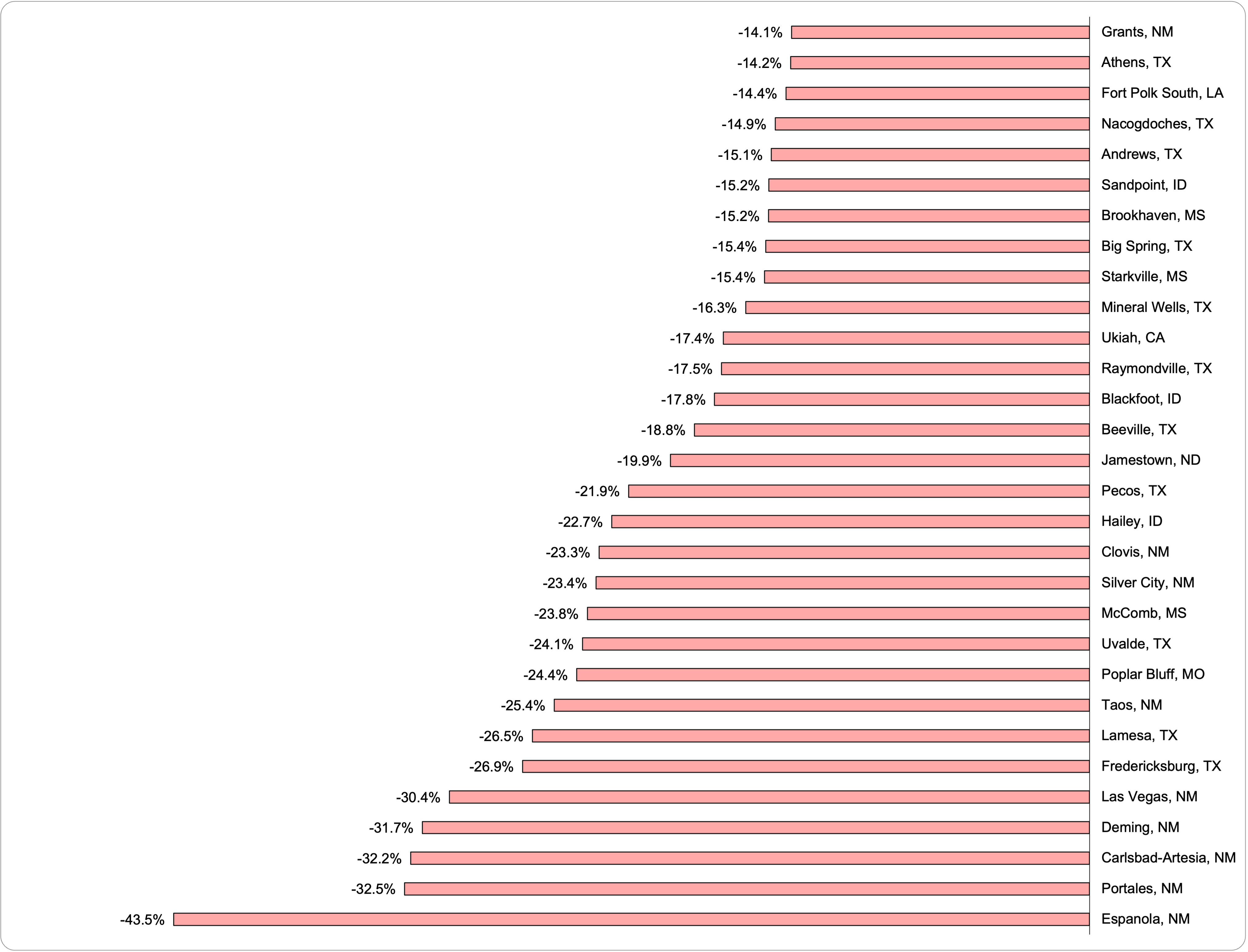

In contrast, CBSAs in New Mexico experienced the steepest declines. Espanola recorded the largest year-over-year drop at 43.5%, followed by Portales (-32.5%) and Carlsbad-Artesia (-32.2%).

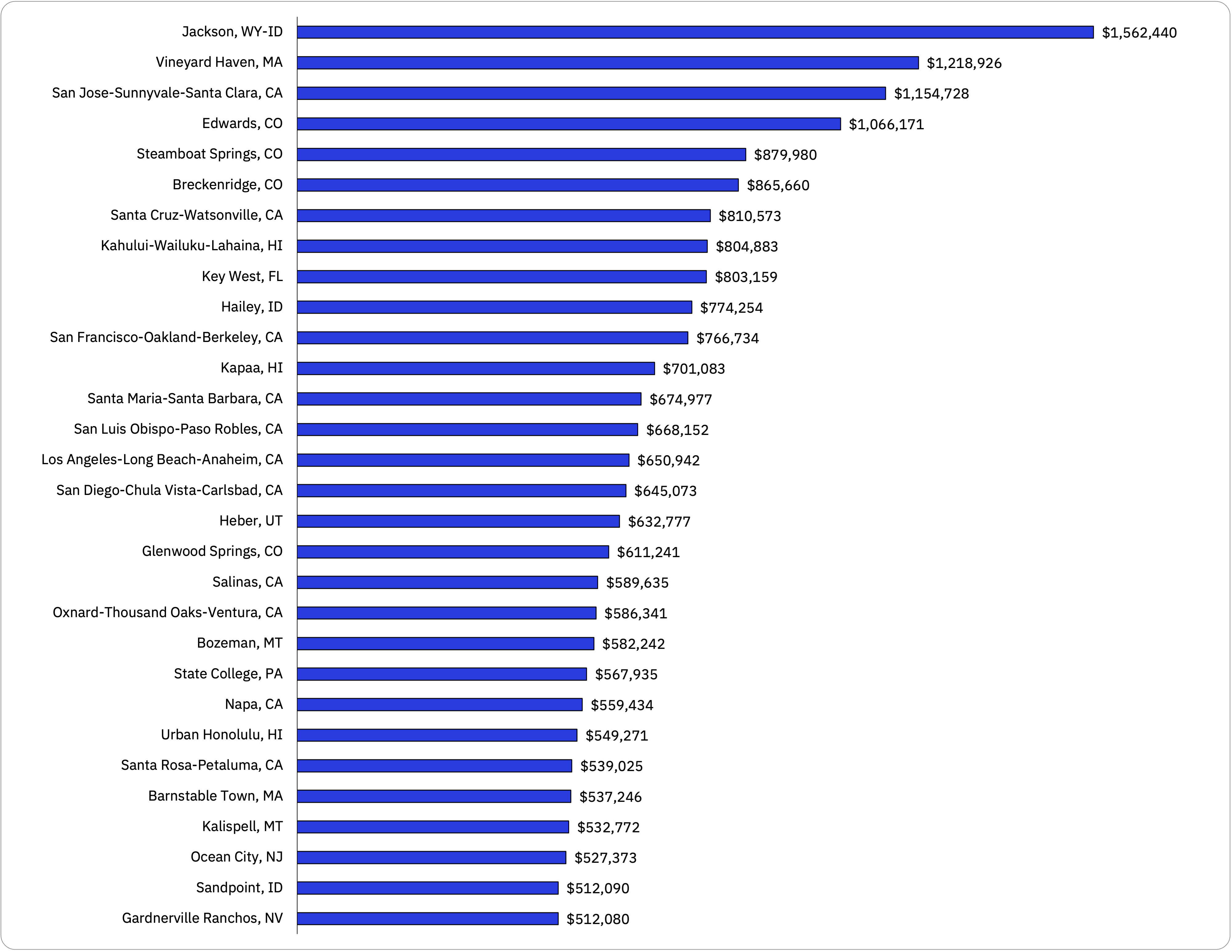

Even greater disparities emerge when examining median home equity levels. The Jackson Micropolitan Statistical Area, spanning Wyoming and Idaho, boasts the highest median home equity in the country at $1,562,4406.

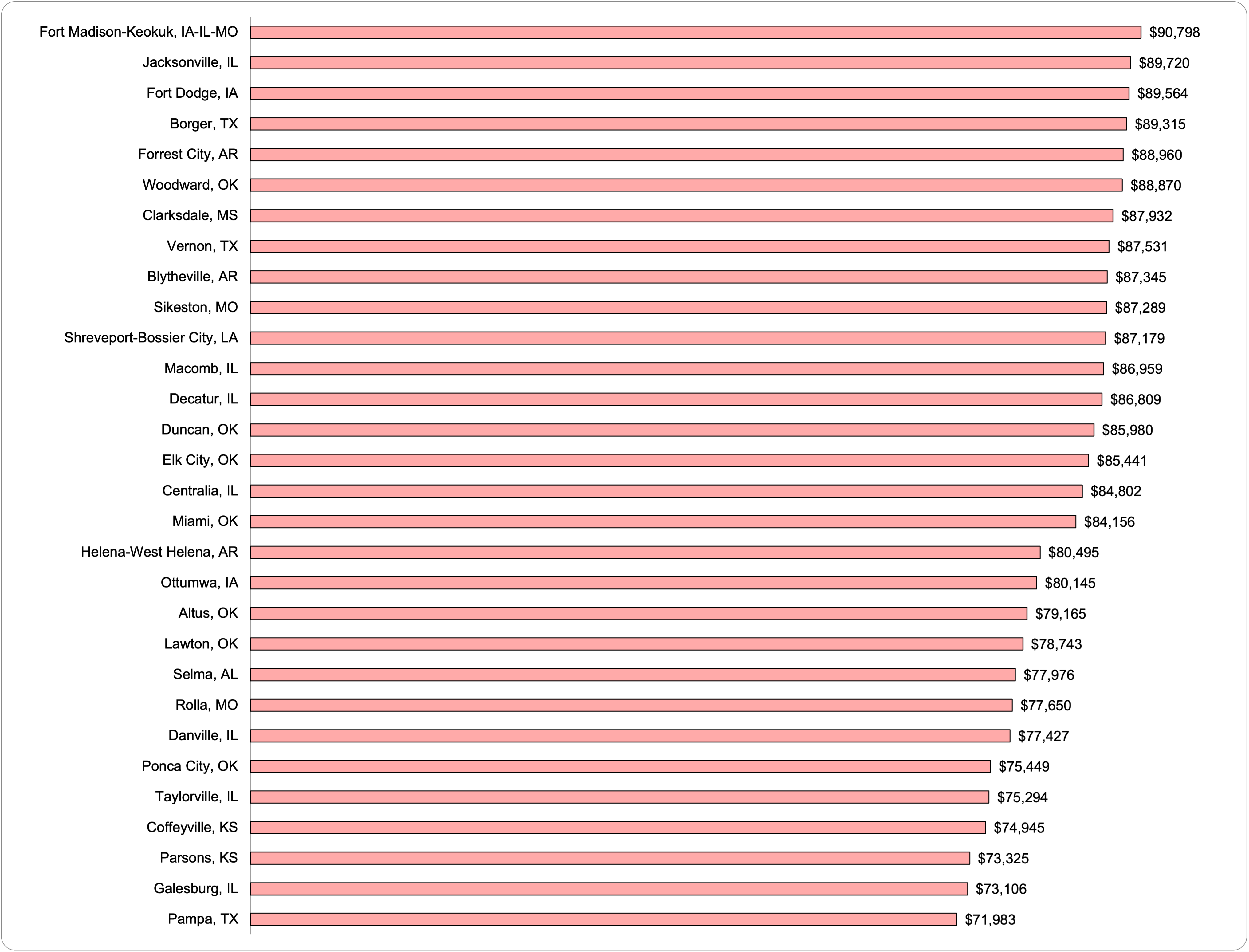

In fact, the highest median home equity in the country is more than twenty times that of the lowest, which is Pampa, Texas at $71,9837.

What does this mean for homeowners?

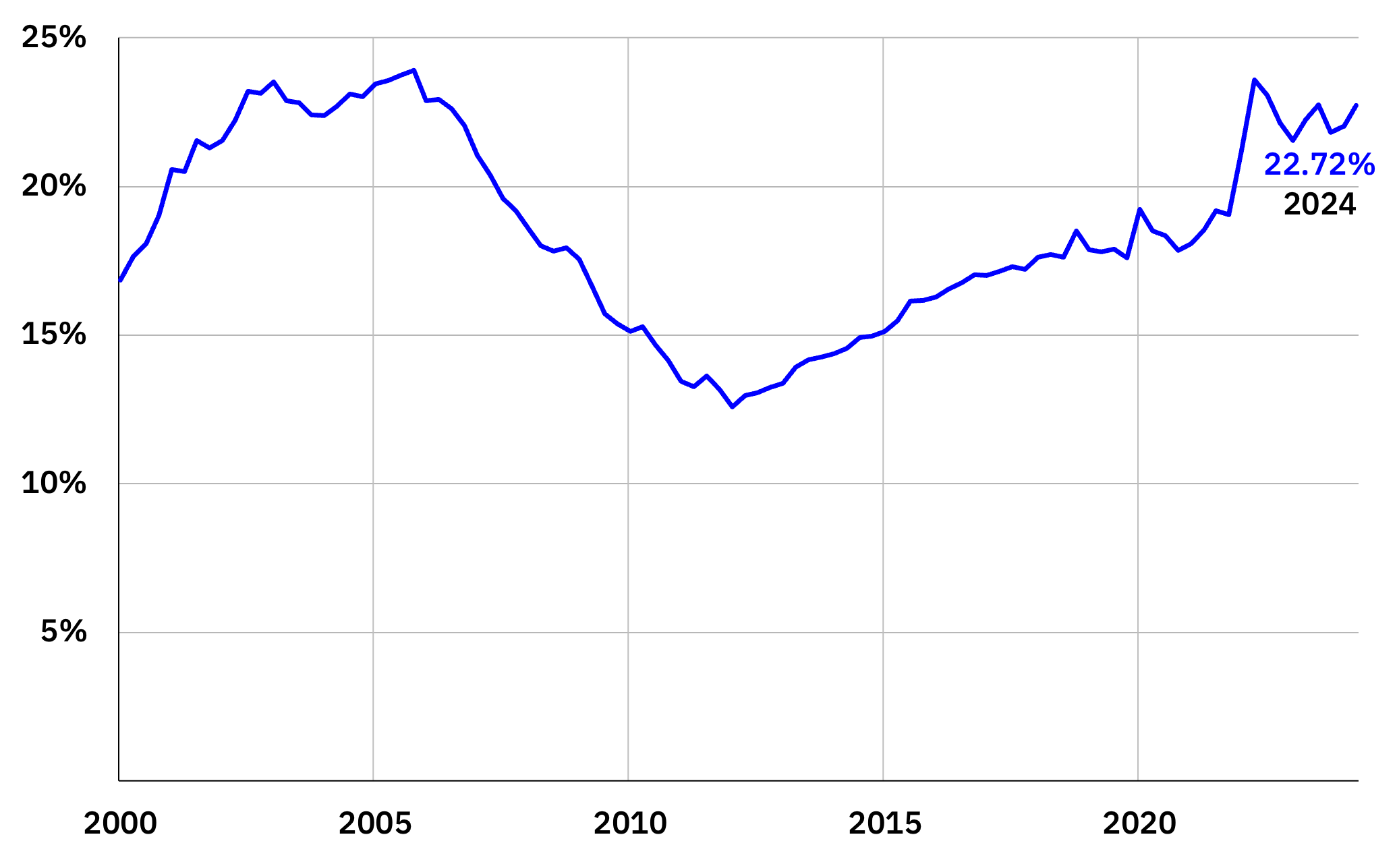

For most U.S. households, their primary residence is likely their largest asset. With the strong growth in home prices over the past few years, home equity has become an increasingly significant portion of household net worth. As of July 2024, home equity accounted for more than one-fifth of total household net worth.

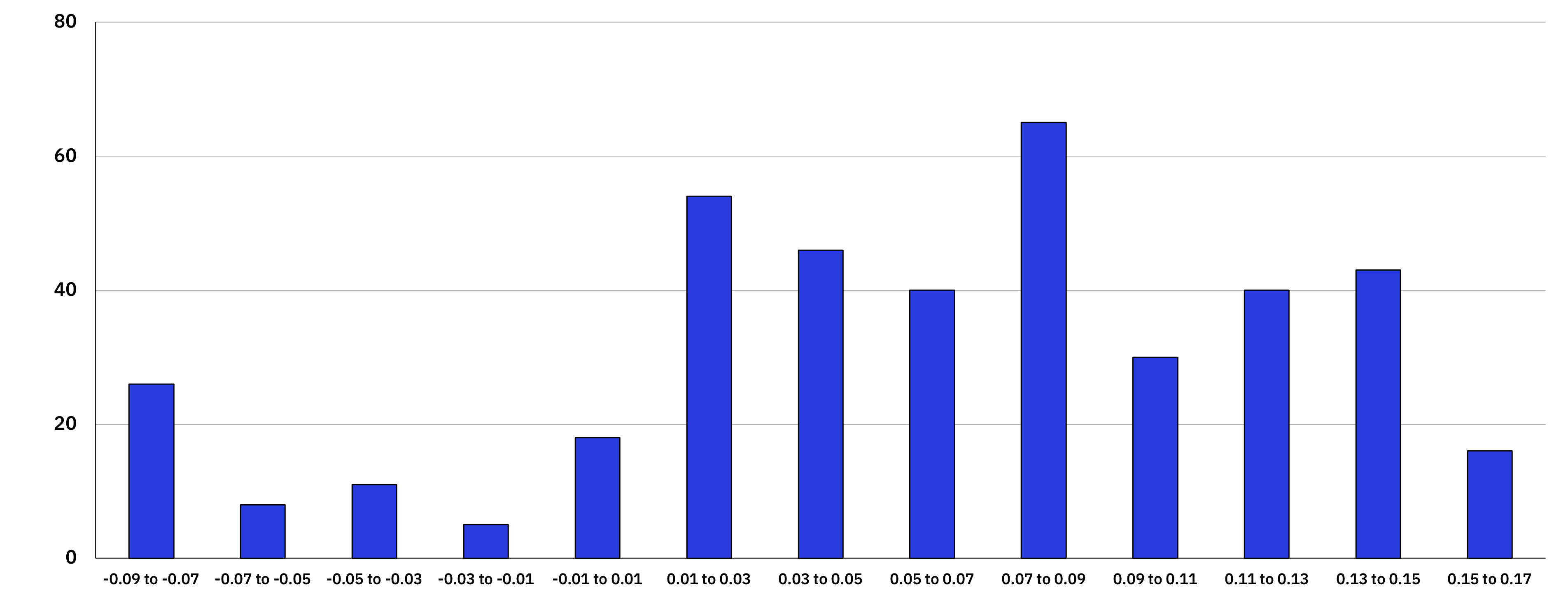

While future home price trends are difficult to predict, the recent rapid pace of price appreciation is historically uncommon. Over the past three years, the national Case-Shiller Index has increased by more than 14%, a rate of growth seen only about 7% of the time in the index's history. Given this exceptional performance, homeowners may want to consider realizing some of these gains, especially if they have liquidity needs.

Unlike more liquid assets like stocks or bonds, home equity is especially challenging to access. Homeowners typically have three main options for withdrawing equity: cash-out refinancing, home equity loans, or home equity lines of credit (HELOCs). Over the past year, there has been an increase in HELOC activity, possibly driven by recent interest rate cuts and the growing awareness among homeowners of the significant value they can tap into for liquidity.

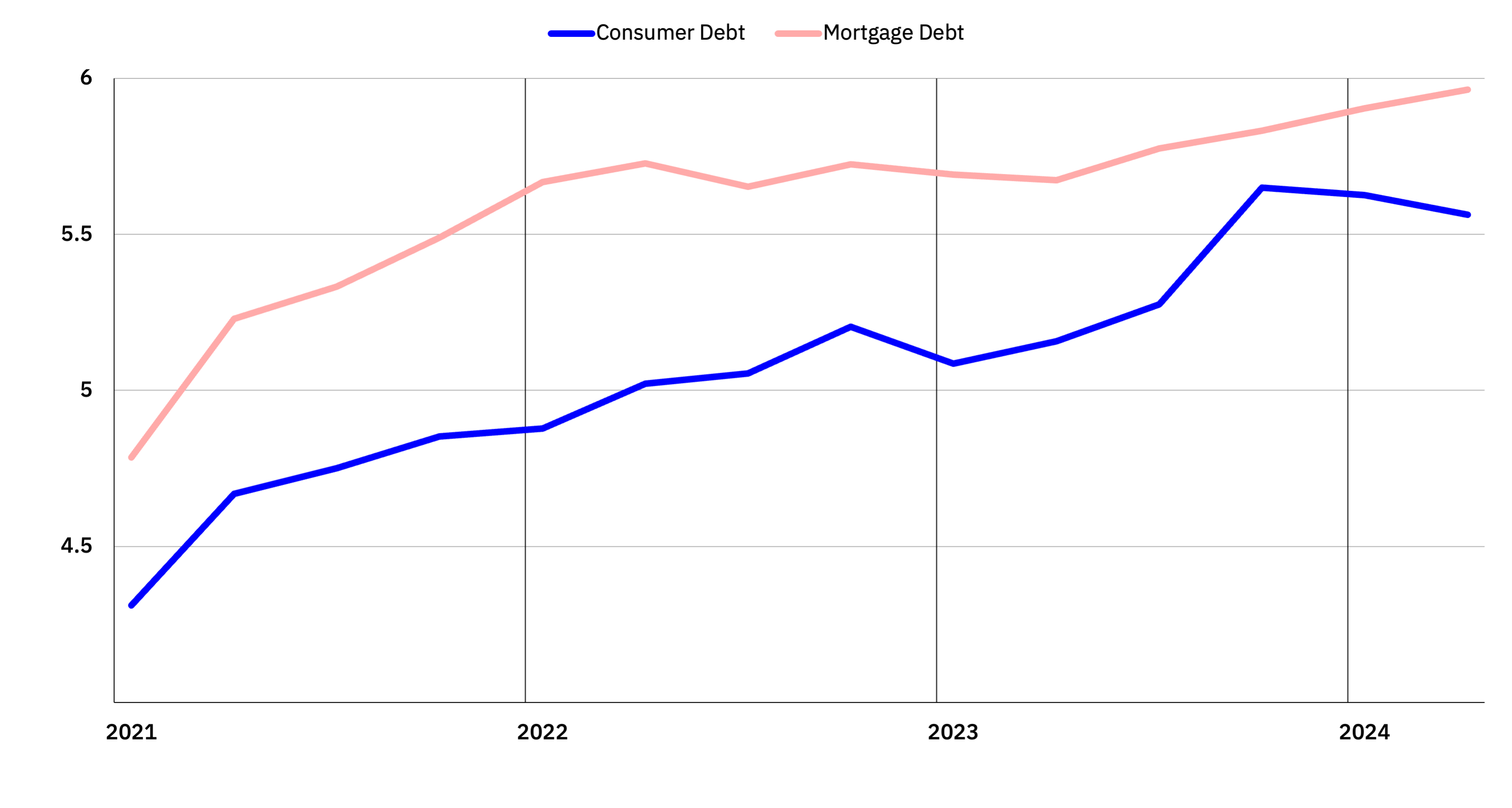

A key distinction between accessing home equity through a HELOC or refinancing versus selling a portion of a retirement portfolio is that HELOCs and mortgages create debt. While these options provide short-term liquidity, they also come with the long-term obligation to service the debt.

In recent years, payments on both consumer and mortgage debt have risen as a percentage of disposable(after-tax) income.

Therefore, while HELOCs offer an appealing way for homeowners to unlock liquidity, it’s essential to consider whether they have the capacity to manage the ongoing payments that accompany this debt.

Within the evolving home equity market, Unison's Equity Sharing Home Loan offers a compelling alternative to traditional second mortgages and HELOCs, particularly in key markets that have seen substantial increases in home equity. The Equity Sharing Home Loan is currently offered in Florida, Colorado, Utah, Arizona, and Oregon - states that have experienced median home equity growth of 9.1%, 3.7%, 1%, 0.2%, and -0.9% respectively over the past year.

The Equity Sharing Home Loan combines the benefits of both debt and equity, allowing homeowners to borrow against their home equity at competitive rates and pay half as much each month as they would with the competition--starting as low as $455 on a $100,000 loan in November 2024. Unlike standard refinancing, the distinct structure includes interest-only payments for up to 10 years, providing immediate access to funds without the financial strain of high monthly costs. Additionally, homeowners can defer a portion of their payments until the end of the loan term, giving them flexibility without prepayment penalties. This structure bridges the gap between homeowners' need for accessible capital and their wealth locked in home equity. It provides liquidity without the higher payment burden typical of traditional home equity products.

For questions about this report, email mediadesk@unison.com or visit our website at unison.com.

About the Author

Unison

We're the pioneers of equity sharing, offering innovative ways for you to gain access to the equity in your home. For more than a decade, we have helped over 12,000 homeowners to pursue their financial goals, from home renovations to debt consolidation, retirement savings, and more.